- You Funded Your Loan

- 10/02/2016 Make a Comment

- Contributed by: Charles ( 12 articles in 2016 )

All debts fall ultimately to the people and to future generations. When banks are “too big to fail” they are bailed out by governments imposing further debt on the people. When governments have a debt crisis, they devise more ways to tax the people. This is because the people are the “credit of the nation”.

When a bank extends credit, for a credit card or a mortgage, it’s your credit, not theirs.

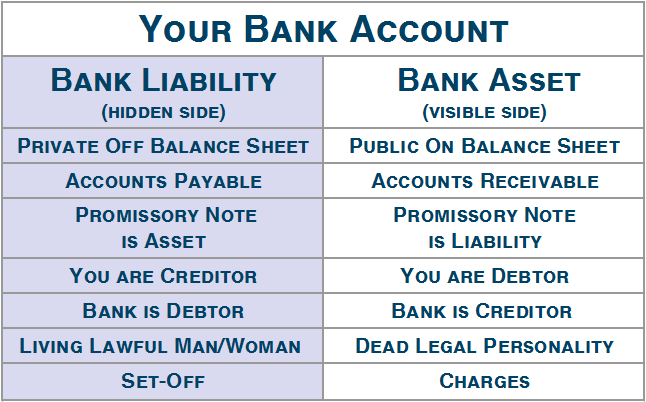

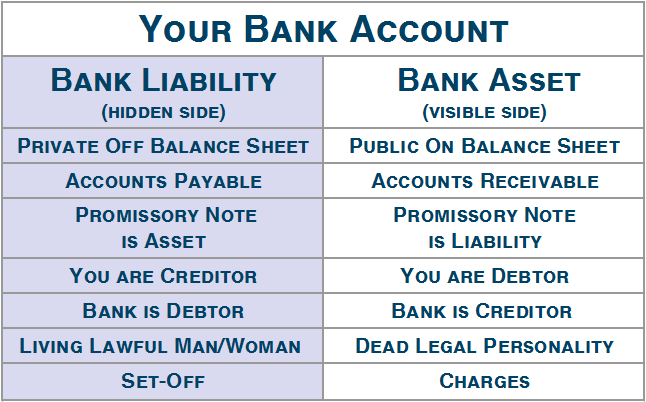

Banks do not loan their customers' deposits, or their bank reserves. Instead, they record your credit as a bank liability on the private side of the ledger (which is hidden), and as a bank asset on the public side of the ledger (which is visible). Just like the Mafia, the banks have two sets of books.

A common misconception, taught in some economic textbooks, is that commercial banks function as intermediaries, lending their customers' deposits whenever the bank makes a “loan”. This deception has been exposed by money reformers advocating sovereign money issuance, supported by considerable evidence, and ultimately confirmed by the administrators of the Bank of England in their first quarterly bulletin of 2014:

“Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.” - Bank of England, Quarterly Bulletin, 2014, Q1

Because of this instant money creation process, it has been said that banks create money “out of thin air”. But bank credit has value in the real economy, so where does that value come from?

If the source of that value was the bank, then the bank would not need customers – commercial banks could simply create as much credit as they wanted. And if the source of that value was somewhere else in the economy other than the people, then again the bank would not need customers – commercial banks would go straight to that source. But commercial banks DO need customers in order to issue credit, so what is it that the customers provide to the bank?

There is only one thing the loan manager in a commercial bank wants from a customer – their signature. The customer's signature on a “promissory note” is what creates the credit by providing “commercial energy”. The “promissory note” represents the “commercial energy” of a living man or woman, which has value, and this energy can be sold and traded.

Why does your “promissory note” have value in the real economy?

Money represents innate human credit as labour and ideas, backed by Nature, and as such it is a medium of exchange for valuable goods and services. In essence, money is “energy” that “circulates” as “currency”, being “charged” and “discharged”. Your credit is only limited by your living energy, your knowledge, and by Nature. You are born with a lifetime of credit, because you have “promise”, and other people can have “faith” in your “promise”. Therefore you can make a “promissory note” with your credit. As the “originator” of your credit, you are the living “principal creditor”.

Any medium of exchange, that allows the flow of productive energy between people, can function as money. There is no need for money to have an intrinsic value because it is simply an “energy token”.

Money is a community invention that enables trade between various parties without direct barter. Therefore, money is a utility, and to remain useful and stable, it should be issued and limited by the community, or nation, that uses it.

However, the corruption of the medium of exchange by commodification, and by private issuance as interest-bearing debt, has hi-jacked the credit (commercial energy) of the people. In the debt-money system, the international bankers have captured and centralised the issuance of the peoples' credit. They have literally become parasitic controllers of the peoples' credit, having engineered the alleged “loan” contract.

Banks can “lend” at interest as long as people, and governments on behalf of the people, are willing to “borrow”.

When you go into a bank for a “loan”, you are taking your credit in the form of your “promise to pay” evidenced by your signature.

On the alleged “loan” contract, your signature transfers your “intellectual property” to the bank, so that the note can be securitised and hypothecated on the market.

When we look at both sides of the ledger, we can see that men and women are creditors, not debtors. That’s right, we loan the bank our credit, and they multiply it in a number of ways. Banks really do “extend credit”, but it's your credit that is extended for their benefit.You are shown only the side of the ledger that records you as a debtor, while the side of the ledger that records you as a creditor is hidden. The banker elites who designed the system did not want you to know that.

On the bank's asset side of the ledger, publicly visible, showing accounts receivable, you are the debtor and the bank is the creditor, while on the banks liability side of the ledger, privately hidden, showing accounts payable, you are the creditor and the bank is the debtor.

Now you know why all debts fall ultimately to the people - you are a creditor, but only when living in your “private capacity” as a man or woman.

When a bank extends credit, for a credit card or a mortgage, it’s your credit, not theirs.

Banks do not loan their customers' deposits, or their bank reserves. Instead, they record your credit as a bank liability on the private side of the ledger (which is hidden), and as a bank asset on the public side of the ledger (which is visible). Just like the Mafia, the banks have two sets of books.

A common misconception, taught in some economic textbooks, is that commercial banks function as intermediaries, lending their customers' deposits whenever the bank makes a “loan”. This deception has been exposed by money reformers advocating sovereign money issuance, supported by considerable evidence, and ultimately confirmed by the administrators of the Bank of England in their first quarterly bulletin of 2014:

“Whenever a bank makes a loan, it simultaneously creates a matching deposit in the borrower’s bank account, thereby creating new money.” - Bank of England, Quarterly Bulletin, 2014, Q1

Because of this instant money creation process, it has been said that banks create money “out of thin air”. But bank credit has value in the real economy, so where does that value come from?

If the source of that value was the bank, then the bank would not need customers – commercial banks could simply create as much credit as they wanted. And if the source of that value was somewhere else in the economy other than the people, then again the bank would not need customers – commercial banks would go straight to that source. But commercial banks DO need customers in order to issue credit, so what is it that the customers provide to the bank?

There is only one thing the loan manager in a commercial bank wants from a customer – their signature. The customer's signature on a “promissory note” is what creates the credit by providing “commercial energy”. The “promissory note” represents the “commercial energy” of a living man or woman, which has value, and this energy can be sold and traded.

Why does your “promissory note” have value in the real economy?

Money represents innate human credit as labour and ideas, backed by Nature, and as such it is a medium of exchange for valuable goods and services. In essence, money is “energy” that “circulates” as “currency”, being “charged” and “discharged”. Your credit is only limited by your living energy, your knowledge, and by Nature. You are born with a lifetime of credit, because you have “promise”, and other people can have “faith” in your “promise”. Therefore you can make a “promissory note” with your credit. As the “originator” of your credit, you are the living “principal creditor”.

Any medium of exchange, that allows the flow of productive energy between people, can function as money. There is no need for money to have an intrinsic value because it is simply an “energy token”.

Money is a community invention that enables trade between various parties without direct barter. Therefore, money is a utility, and to remain useful and stable, it should be issued and limited by the community, or nation, that uses it.

However, the corruption of the medium of exchange by commodification, and by private issuance as interest-bearing debt, has hi-jacked the credit (commercial energy) of the people. In the debt-money system, the international bankers have captured and centralised the issuance of the peoples' credit. They have literally become parasitic controllers of the peoples' credit, having engineered the alleged “loan” contract.

Banks can “lend” at interest as long as people, and governments on behalf of the people, are willing to “borrow”.

When you go into a bank for a “loan”, you are taking your credit in the form of your “promise to pay” evidenced by your signature.

On the alleged “loan” contract, your signature transfers your “intellectual property” to the bank, so that the note can be securitised and hypothecated on the market.

When we look at both sides of the ledger, we can see that men and women are creditors, not debtors. That’s right, we loan the bank our credit, and they multiply it in a number of ways. Banks really do “extend credit”, but it's your credit that is extended for their benefit.You are shown only the side of the ledger that records you as a debtor, while the side of the ledger that records you as a creditor is hidden. The banker elites who designed the system did not want you to know that.

On the bank's asset side of the ledger, publicly visible, showing accounts receivable, you are the debtor and the bank is the creditor, while on the banks liability side of the ledger, privately hidden, showing accounts payable, you are the creditor and the bank is the debtor.

Now you know why all debts fall ultimately to the people - you are a creditor, but only when living in your “private capacity” as a man or woman.

Source: https://livingintheprivate.blogspot.com.au/p/you-funded-your-loan.html

1Will not be visible to public.

2Receive notification of other comments posted for this article. To cease notification after having posted click here.

3To make a link clickable in the comments box enclose in link tags - ie.<link>Link</link>.

4To show an image enclose the image URL in tags - ie.<image>https://fredspage.com/box.jpg</image>. Note: image may be resized if too large

To further have your say, head to our forum Click Here

To contribute a news article Click Here

To view or contribute a Quote Click Here